“How do I pay without a credit card, Dad?” My daughter learned to budget and manage her credit in high school. Yes, there were late payment fees and interest. These were painful lessons made less so by low credit limits and low expectations for credit ratings. My painful lesson came 3 years later when she needed to pay a deposit for rent. I hadn’t taught her how to write a check.

If you pay by cash, check or debit, you’re losing money.

Yes, she had a checking account – but no checks. As someone who seeks to maximize credit card rewards and minimize even small expenses like stamps and envelopes, I paid by ACH or bank checks for everything that didn’t accept credit card payments. I encouraged her to do the same. I explained that the cost retailers pay to credit card payment processors is built into the price we pay. So, if you pay by cash, check or debit, you’re losing money. The additional income gained from delaying payment was an additional reason. But with virtually non-existent interest rates in checking accounts, it wasn’t worth the additional explanation. Now, she needed to be able to pay rent and utilities – none of which accepted credit cards or offered ACH payments.

What Happened to Checks?

Startups like Square ($SQ) in 2010 forced established payment processors to innovate or acquire other startups in the highly competitive credit card payment processor market. North American Bancard, part of Wells Fargo ($WFC), launched PayAnywhere in 2011. In 2012, PayPal ($PYPL) launched PayPal Here, and First Data ($FDC) acquired Clover. In 2017, Chase JP Morgan ($JPM) acquired Wepay.

Banks were already adding ACH payments, mobile deposits and more. A 2012 study by the Philadelphia Federal Reserve showed an annual decline in check volume of almost 2 billion, predicting a final demise in 2026. A 2015 study by Digital Check supports similar declines in check volume, but predicts ACH and digital currencies like BitCoin to grow. The Digital Check study concludes that debit cards have replaced personal checks for low-value point-of-sale transactions, while ACH continues to replace checks for high-value payments. But it does not address the growth of credit card rewards programs or the risks and challenges of digital currencies.

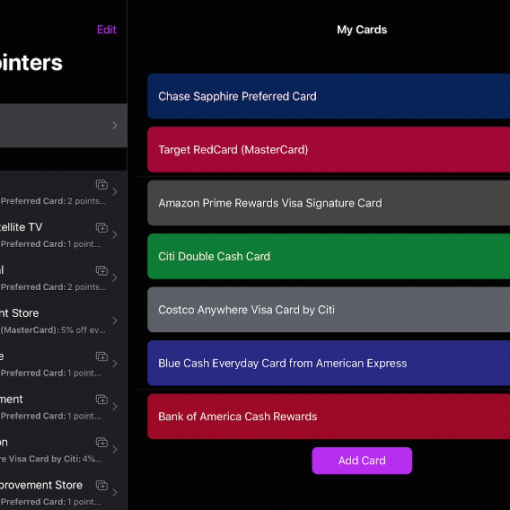

The Rise of Credit Cards and Digital Payments

Even with the increase in digital payments, the use of credit cards is on the rise. A 2016 study by TSYS showed a preference for credit cards for the first time. In that study, 40% of US consumers preferred credit cards to other forms of payment. The study found that rewards were the most attractive card feature on consumers’ most preferred credit cards.

As the cost, convenience and rewards of credit and debits cards, digital payments and ACH transactions continues to improve, you might ask yourself, “Are checks dead?” Though checks still have a place among modern forms of payment, their use continues to decline.