The Federal Reserve continues to cut the prime interest rate, but banks and credit unions continue to offer attractive options topping 5% with few requirements. The latest OPM Comparison of the best checking and savings accounts includes strong options from newcomers PenAir Credit Union, Vibrant Credit Union, Timbr Financial and Newtek Bank. Having multiple accounts allows you to maximize the passive income on your bill paying and emergency savings accounts and circumvent withdrawal limits.

For more info on the factors used in OPM comparisons, check out How to compare deposit accounts?

Note: Unlike other sites, OPM receives no compensation from publishing or linking in this or any other post.

Checking

Checking accounts might be better known as “spend” accounts as they support unlimited transactions for bill payment, direct purchases via debit cards, person-to-person payments, and cash withdrawal in limited amounts. Due to the relaxation of the Federal Reserve Board’s Regulation D limit “convenient” transactions in savings accounts, many Money Market accounts offer checking account features and are included in the OPM Comparison of checking accounts. Note: always refer to the financial institution for the latest rates and information.

Checking accounts might be better known as “spend” accounts as they support unlimited transactions for bill payment, direct purchases via debit cards, person-to-person payments, and cash withdrawal in limited amounts. Due to the relaxation of the Federal Reserve Board’s Regulation D limit “convenient” transactions in savings accounts, many Money Market accounts offer checking account features and are included in the OPM Comparison of checking accounts. Note: always refer to the financial institution for the latest rates and information.

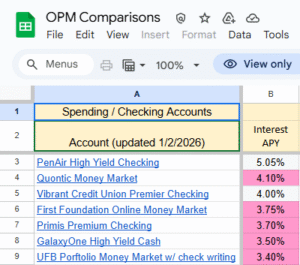

PenAir Credit Union High‑Yield Checking

- 5.05% APY with eStatements + a monthly ACH deposit of $250 (as of January 2, 2026)

- Warning: The 5.05% APY only applies up to $10,000, after which the APY is 0%.

Vibrant Credit Union Premier Checking and Savings

- 4.00% APY (as of January 2, 2026)

- Warning: The 4.0% APY only applies up to $25,000, after which the APY is 0%.

Primis Premium Checking

- 3.7% APY (as of January 2, 2026), has been in the OPM Comparison top 10% for over 1 year

- Note: Primis has no fees, limits or APY requirements, unlimited ATM reimbursement, free cashier’s checks, and the first 40 checks are free

Savings

The purpose of emergency savings is quick access to cash to cover urgent needs. Emergency savings is kept in traditional savings accounts, money market accounts, or even checking accounts and an online hybrid often referred to as “cash accounts” which offer access within minutes or days. The price of this liquidity is generally lower returns than other investments, but recent times have shown cash accounts often exceed more limited investments like CDs, which require much longer delays to access cash. Two of the top accounts only allow ACH withdrawals to the same account used to fund the savings account, which limits flexibility, but may be acceptable for many.

The purpose of emergency savings is quick access to cash to cover urgent needs. Emergency savings is kept in traditional savings accounts, money market accounts, or even checking accounts and an online hybrid often referred to as “cash accounts” which offer access within minutes or days. The price of this liquidity is generally lower returns than other investments, but recent times have shown cash accounts often exceed more limited investments like CDs, which require much longer delays to access cash. Two of the top accounts only allow ACH withdrawals to the same account used to fund the savings account, which limits flexibility, but may be acceptable for many.

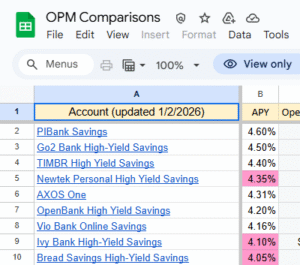

Check out the latest OPM Comparison of savings accounts. Note: always refer to the financial institution for the latest rates and information.

Timbr Financial High‑Yield Savings

- APY: 4.40% (as of January 2, 2026)

- Withdrawals: ACH only to the funding account; there is no mobile app and the account does not work with account aggregators like Quicken or Empower Personal Wealth (formerly Personal Capital)

Newtek Bank Personal High-Yield Savings

- APY: 4.35% (as of January 2, 2026)

- Warning: Withdrawals are limited to ACH only to the funding account up to $25K per day and 6 per statement cycle; does not work with Quicken

Vio Bank Online Savings

- APY: 4.16% (as of January 2, 2026), has been in the OPM Comparison top 10% frequently over the last 4 years

- Note: only fee is for paper statements (optional)