Banks, credit unions and non-bank financial institutions (NBFIs) offer many types of deposit accounts with features to support several purposes, including spending (aka checking), emergency savings, and long-term savings. The growth of hybrid accounts, often referred to as “cash accounts,” mix features that make comparing options more challenging. These types include traditional checking and savings accounts and certificates of deposit (CDs), as well as money market, rewards checking, high-yield savings, sweep accounts for investment brokerage accounts. Let’s look at the comparison factors that are common among account types, as well as those that are specific to spending and saving accounts.

Common Comparison Factors

APY and Minimum to get APY

The annual percentage yield (APY) indicates the amount of interest earned, usually as a percentage of the average amount of the compounding frequency, which is usually daily, monthly or a statement cycle (28-30 days). In recent times, some spending account offer interest rates that compete (and sometime beat) savings accounts. Likewise, savings accounts often offer better rates than CDs, without the lengthy maturity periods.

Deposit / Withdrawal Methods

The methods to deposit and withdraw money along with funds availability can significantly impact your use of the accounts. The easier and faster you can move money, the more interest you’ll earn – or avoid if you’re paying bills.

ACH

The Automated Clearing House (ACH) system allows near real-time settlement of transfers between financial institutions. This system is managed by and follows rules set by the National Automated Clearing House Association (NACHA), which process billions of transactions each year via 2 national ACH operators: the Federal Reserve Banks and the Electronic Payments Network (EPN). Same-day ACH became possible in 2017 and was improved in 2021, and requires domestic ACH transactions under $25,000 posted before 2:45pm ET to be cleared in the 5pm ET batch on the same day.

ATM

ATM using debit cards, if supported, enable limited but immediate access to cash. Though usually offered by spend accounts, debit cards are not common with savings accounts. However, when rules for transaction limits on savings accounts were relaxed during COVID, the availability of debit cards on money market and traditional savings accounts became more common, in part because it also makes depositing money quicker and more convenient.

Checks

Although the use of paper checks continues to decline, many cash and deposit accounts now support mobile check deposits by scanning the checks in a mobile app. Check deposits often make money available instantly, some require 1-3 days to become available. Check fraud remains a problem, so financial institutions often charge fees for processing checks with non-sufficient funds (NSF).

Wire Transfer

Wiring money between accounts is often quick – if the bank is open when you need the money, and wiring fees can reduce the passive (interest) income. A few accounts only allow withdrawals by wire transfers, which is inconvenient and expensive. Caveat emptor! Note: Since wire transfer only is rare, OPM Comparisons notes this as an exception.

Funds Availability

While the availability of funds for certain transactions like direct deposit and ACH transactions is governed by laws or rules, funds availability for other transactions can vary widely. This mostly affects checks, which can range from 1 to 7 days (yes, a week!) depending on the amount and account history. It’s important to read the fine print to avoid penalties for late payments and overdrafts!

Deposit Insurance Coverage

Most US banks are insured by the Federal Deposit Insurance Corporation (FDIC), protecting depositors against loss if the bank fails, covering eligible accounts up to $250,000. Most US credit unions offer similar coverage through NCUA. Note: Since this is commonly supported, OPM Comparisons note the exceptions where this is not supported.

Many financial institutions offer extended insurance beyond $250,000 by using bank networks like IntraFi’s Cash Service (ICS) and Certificate of Deposit Account Registry Service (CDARS) programs to automatically distribute deposits beyond FDIC limits across multiple FDIC-insured banks in their network. Important: If you have accounts in multiple financial institutions, be sure you know which FDIC numbers (routing numbers) are covered in the network to avoid unpleasant surprises.

The FDIC’s Electronic Deposit Insurance Estimator (EDIE) “lets consumers…know, on a per-bank basis, how the insurance rules and limits apply to a depositor’s specific group of deposit accounts—what’s insured and what portion (if any) exceeds coverage limits at that bank.”

Maintenance Fees

Some financial institutions charge small monthly fees to maintain low profit accounts, more often with spending accounts, but also some savings accounts. These fees can often be avoided by one or more of the following conditions: maintaining a minimum balance across, having multiple accounts with a financial institution, using direct deposit of salary, depositing a minimum amount into the account, receiving digital statements and communications instead of paper in the mail, and / or completing a minimum number of debit card purchases each statement cycle.

Dormant account fee

Some financial institutions charge a small monthly fee for inactive accounts, that is, accounts with no activity for a specified number of months (e.g. 3, 6, 12 months). This can be avoided by closing inactive accounts or by scheduling small transfers within the inactivity period.

Account Aggregation

Many financial institutions enable tracking accounts from other providers and like enable visibility to account balances and transactions to other financial institutions and applications. This is important if you want to reconcile transactions in Quicken or other financial software or track net worth in Empower Personal Wealth or other account aggregators. Note: Since this is commonly supported, OPM Comparisons note the exceptions where this is not supported.

Spending Comparison Factors

Overdraft fees

Financial institutions often charge fees when account funds are not sufficient to cover a withdrawal (e.g. check, ATM withdrawal, automatic bill payment), often referred to as NSF (non-sufficient funds) fees. There are many ways to avoid overdraft fees, including declining overdraft coverage which causes the bank to reject withdrawals that would result in an overdraft. This is increasingly common as a default “feature”: no overdraft fees.

Bill Pay

Many spending accounts, including some money market accounts, support electronic bill payment, which directly transfers money to payees and often mails checks to payees that don’t have established online payment systems, which is common for rent, HOA and other small vendors.

Person-to-Person (P2P) payments

Speaking of small vendors, you might also wish to send money to friends or individuals that is unrelated to a product or service. Most spending accounts that include a routing number and account number can be used with Cash App, PayPal, Venmo and many other payment services, but Zelle must be specifically supported by the financial institution.

Check out the OPM Comparison of Spending (Checking) accounts, but always refer to the financial institution for the latest rates and information.

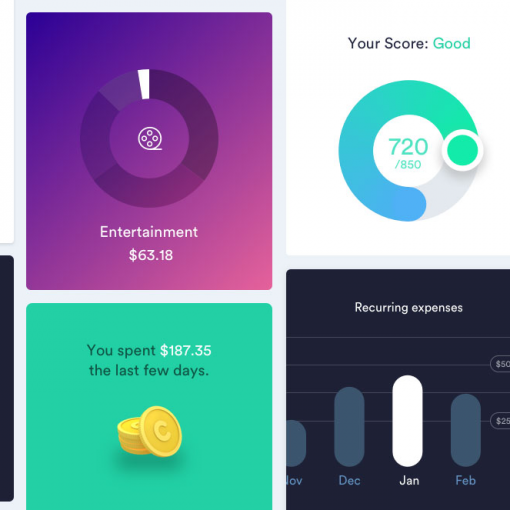

Savings Comparison Factors

The purpose of emergency savings is quick access to cash to cover urgent needs. Emergency savings is kept in traditional savings accounts, money market accounts, or even checking accounts and an online hybrid often referred to as “cash accounts” which offer access within minutes or days. The price of this liquidity is generally lower returns than other investments, but recent times have shown cash accounts often exceed more limited investments like CDs, which require much longer delays to access cash. In addition to the return, typically measured by the APY – Annual Percentage Yield, withdrawal speed and flexibility are key comparison factors.

Withdrawal limits, methods, availability and target accounts determine how quickly you can respond to emergencies (assuming, of course, that you have enough money in your accounts). Common withdrawal methods include ACH, ATM (via debit card), checks, and wire transfers.

Minimum to open

Although most financial institutions require less than $500, if anything, to open savings account, some require much larger amounts, especially if the APY is high, to discourage rate shopping and low balance accounts.

Withdrawal limits

Federal Reserve Regulation D limited convenient withdrawals (debit, checks, bill payments and other online transactions) to 6 per month. Although this regulation was relaxed in 2020 during COVID, many banks continue to limit the number of amount of withdrawals. Withdrawal limits are a good reason to have multiple savings accounts.

Check out the OPM Comparison of Savings accounts, but always refer to the financial institution for the latest rates and information.